How much is auto insurance in Massachusetts? This question sparks curiosity and leads us to explore the various factors that determine insurance rates in the state. From driver demographics to vehicle types, each element plays a crucial role in shaping insurance premiums. Let’s delve into the intricacies of auto insurance costs in Massachusetts.

We will uncover the average costs, minimum requirements, available discounts, and more to provide a comprehensive understanding of auto insurance in the state.

Factors influencing auto insurance rates in Massachusetts

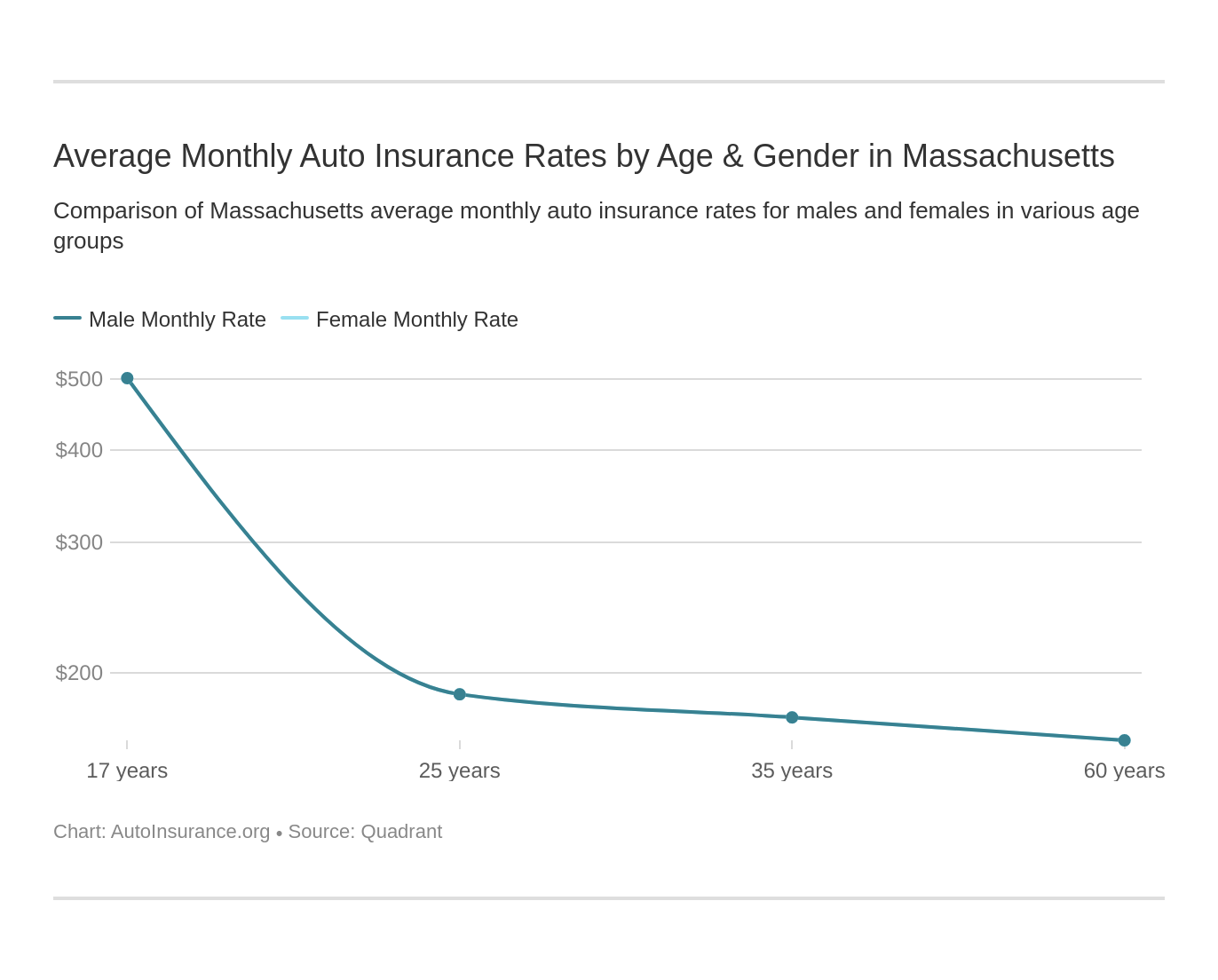

When it comes to determining auto insurance rates in Massachusetts, several key factors play a significant role. The driver’s age, driving record, location, and type of vehicle are among the primary influencers that impact insurance premiums.

Driver’s Age

Younger drivers typically face higher insurance rates due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older, more experienced drivers may qualify for lower rates.

Driving Record

A clean driving record with no accidents or traffic violations can lead to lower insurance premiums. Conversely, a history of accidents or traffic infractions may result in higher rates.

Location

The area where a driver lives can also affect insurance rates. Urban areas with higher rates of accidents and thefts may have higher premiums compared to rural areas with lower traffic congestion.

Type of Vehicle

The make and model of the vehicle can impact insurance rates. Sports cars or luxury vehicles may be more expensive to insure due to their higher repair costs and increased risk of theft.

Average cost of auto insurance in Massachusetts

Research shows that the average annual cost of auto insurance for drivers in Massachusetts is around $1,200 to $1,400. However, these rates can vary based on different age groups or vehicle types.

Comparison by Age Groups, How much is auto insurance in massachusetts

Drivers under 25 years old tend to have higher insurance rates compared to older age groups. This is due to the higher risk associated with younger, less experienced drivers.

Trends in Auto Insurance Pricing

Over the past few years, auto insurance pricing in Massachusetts has seen fluctuations due to changes in driving patterns, economic conditions, and insurance regulations.

Minimum auto insurance requirements in Massachusetts

In Massachusetts, drivers are required to carry a minimum auto insurance coverage that includes liability insurance, personal injury protection (PIP), and uninsured motorist coverage.

Types of Coverage

– Liability insurance: Covers damages and injuries to others in an at-fault accident.

– Personal Injury Protection (PIP): Provides coverage for medical expenses and lost wages.

– Uninsured Motorist Coverage: Protects against damages caused by uninsured or underinsured drivers.

Discounts and savings on auto insurance in Massachusetts

Insurance companies in Massachusetts offer various discounts to help drivers save on their premiums. Common discounts include safe driver discounts, multi-policy discounts, and good student discounts.

Qualifying for Discounts

To qualify for discounts, drivers can maintain a clean driving record, bundle multiple insurance policies, or demonstrate academic excellence.

Closing Summary: How Much Is Auto Insurance In Massachusetts

In conclusion, understanding how much auto insurance costs in Massachusetts involves considering multiple factors that influence insurance rates. By exploring the key elements that impact pricing and requirements, drivers can make informed decisions to secure the right coverage at the best possible rates.

Questions and Answers

What factors influence auto insurance rates in Massachusetts?

Factors such as driver’s age, driving record, location, and vehicle type can significantly impact auto insurance premiums in Massachusetts.

What are the minimum auto insurance requirements in Massachusetts?

Massachusetts law mandates specific minimum coverage types that drivers must carry, including bodily injury and property damage liability.

How can drivers qualify for discounts on auto insurance in Massachusetts?

Insurance companies in Massachusetts offer various discounts based on factors like safe driving records, bundled policies, and vehicle safety features.