Can you cancel claim car insurance? This question opens the door to a complex yet crucial aspect of insurance claims. Let’s delve into the reasons, procedures, and impact of canceling a claim to gain a comprehensive understanding.

Exploring the intricacies of canceling a car insurance claim can provide valuable insights for policyholders navigating the insurance landscape.

Reasons for Canceling a Claim

When it comes to car insurance claims, there are situations where canceling a claim may be necessary. For example, if the damage to your vehicle is minimal and you can cover the repair costs out of pocket, canceling the claim can help you avoid potential increases in your insurance rates. Canceling a claim can also be advisable if the claim was filed in error or if the circumstances have changed since the claim was made. However, it’s essential to consider the impact that canceling a claim may have on your future insurance rates.

Procedures for Canceling a Claim

To cancel a car insurance claim, you will need to contact your insurance provider and inform them of your decision. They will guide you through the necessary steps and may require specific documentation to process the cancellation. It’s crucial to be aware of any deadlines or timeframes for canceling a claim to ensure that the process is completed in a timely manner.

Alternatives to Canceling a Claim, Can you cancel claim car insurance

If canceling a car insurance claim is not feasible, there are alternatives to consider. For example, you may choose to negotiate a settlement with the other party involved in the accident or explore other coverage options within your policy. These alternatives can help you avoid the repercussions of canceling a claim and maintain a positive relationship with your insurance provider.

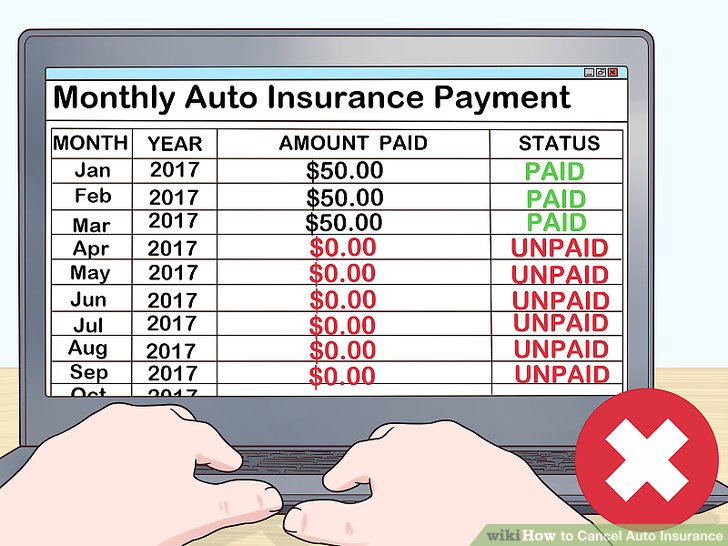

Impact of Canceling a Claim

Canceling a car insurance claim can affect your coverage in various ways. It may impact your ability to file future claims or result in changes to your deductible or coverage limits. Additionally, there may be financial implications associated with canceling a claim, such as forfeiting any reimbursement for damages. It’s essential to weigh the pros and cons of canceling a claim and consider how it may influence your relationship with your insurance provider.

Last Word: Can You Cancel Claim Car Insurance

In conclusion, understanding the nuances of canceling a car insurance claim is essential for making informed decisions that can impact your coverage and financial well-being. Delve deeper into the intricacies of insurance claims to navigate the process effectively.

FAQ

Can I cancel a car insurance claim once it’s been filed?

Yes, you can cancel a car insurance claim even after it has been filed. However, the process and implications may vary depending on the insurance provider and the specific circumstances of the claim.

Will canceling a claim affect my future insurance rates?

Canceling a claim may or may not affect your future insurance rates. It’s essential to check with your insurance provider to understand how canceling a claim could impact your policy.

What are the alternatives to canceling a car insurance claim?

Alternatives to canceling a car insurance claim include withdrawing the claim, amending the claim details, or negotiating with the insurance company for a different resolution.

How does canceling a claim impact my relationship with the insurance provider?

Canceling a claim could impact your relationship with the insurance provider, as it may affect their perception of your claims history and credibility. It’s important to consider the implications before making a decision.